Bagley Risk Management : Protecting Your Company Future

Wiki Article

How Livestock Danger Security (LRP) Insurance Coverage Can Protect Your Livestock Investment

In the world of animals financial investments, mitigating risks is paramount to making certain financial stability and development. Livestock Threat Defense (LRP) insurance policy stands as a trustworthy shield against the unforeseeable nature of the market, offering a tactical strategy to guarding your assets. By diving right into the complexities of LRP insurance policy and its complex benefits, animals manufacturers can strengthen their investments with a layer of safety that transcends market changes. As we explore the world of LRP insurance, its function in safeguarding livestock investments comes to be increasingly obvious, assuring a course in the direction of lasting economic resilience in a volatile market.

Comprehending Animals Danger Security (LRP) Insurance Policy

Comprehending Animals Danger Defense (LRP) Insurance coverage is vital for animals manufacturers looking to mitigate economic threats associated with cost changes. LRP is a government subsidized insurance coverage item created to shield producers versus a decrease in market costs. By providing coverage for market rate decreases, LRP aids manufacturers secure in a floor price for their livestock, making certain a minimal level of revenue no matter of market variations.One key aspect of LRP is its adaptability, enabling manufacturers to customize coverage degrees and policy sizes to match their particular needs. Producers can pick the number of head, weight array, insurance coverage rate, and coverage duration that straighten with their manufacturing goals and take the chance of resistance. Understanding these adjustable choices is vital for manufacturers to successfully manage their rate threat exposure.

Furthermore, LRP is readily available for different livestock kinds, consisting of cattle, swine, and lamb, making it a versatile risk monitoring device for livestock producers across various fields. Bagley Risk Management. By familiarizing themselves with the intricacies of LRP, manufacturers can make educated choices to guard their financial investments and make certain financial stability despite market unpredictabilities

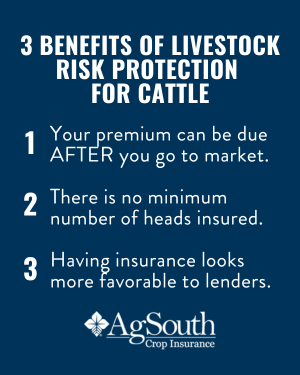

Advantages of LRP Insurance Coverage for Animals Producers

Animals producers leveraging Livestock Threat Security (LRP) Insurance coverage get a calculated benefit in securing their investments from rate volatility and safeguarding a steady financial ground in the middle of market unpredictabilities. By setting a floor on the cost of their animals, manufacturers can alleviate the danger of substantial economic losses in the occasion of market slumps.

In Addition, LRP Insurance policy offers manufacturers with peace of mind. In general, the advantages of LRP Insurance coverage for animals producers are substantial, using an important tool for taking care of risk and making sure economic protection in an unforeseeable market environment.

Just How LRP Insurance Policy Mitigates Market Dangers

Mitigating market threats, Livestock Risk Defense (LRP) Insurance coverage supplies livestock producers with a trustworthy guard against price volatility and monetary unpredictabilities. By supplying security against unforeseen price decreases, LRP Insurance policy assists manufacturers secure their financial investments and preserve financial stability when faced with market variations. discover this info here This kind of insurance coverage enables animals producers to secure a cost for their pets at the beginning of the plan period, making sure a minimum cost level regardless of market changes.

Steps to Safeguard Your Livestock Investment With LRP

In the realm of agricultural risk monitoring, implementing Animals Danger Defense (LRP) Insurance involves a tactical procedure to guard investments against market fluctuations and unpredictabilities. To safeguard your livestock financial investment properly with LRP, the initial step is to examine the particular risks your operation deals with, such as price volatility or unforeseen weather events. Next, it is essential to research study and choose a reliable insurance coverage company that uses LRP plans customized to your animals and company needs.Long-Term Financial Security With LRP Insurance

Guaranteeing sustaining financial security through the utilization of Animals Danger Protection (LRP) Insurance policy is a prudent lasting technique for agricultural producers. By integrating LRP Insurance coverage into their danger management plans, farmers can safeguard their livestock financial investments against unpredicted market changes and adverse occasions that might endanger their economic health in time.One secret advantage of LRP Insurance policy for lasting monetary protection is the tranquility of mind it uses. With a reputable insurance policy in position, farmers can reduce the financial risks Your Domain Name related to unstable market problems and unforeseen losses as a result of variables such as illness break outs or natural catastrophes - Bagley Risk Management. This stability enables producers to focus on the day-to-day procedures of their animals company without continuous stress over prospective financial obstacles

In Addition, LRP Insurance policy provides a structured approach to taking care of danger over the long term. By setting details coverage degrees and selecting ideal endorsement durations, farmers can customize their insurance policy plans to align with their economic objectives and run the risk of tolerance, guaranteeing a safe and sustainable future for their livestock operations. Finally, buying LRP Insurance is a proactive method for farming producers to achieve lasting financial security and secure their source of incomes.

Final Thought

To conclude, Animals Risk Protection (LRP) Insurance is a valuable device for livestock producers to reduce market threats and safeguard their financial investments. By recognizing the benefits of LRP insurance coverage and taking steps to execute it, producers can achieve long-lasting economic protection for their operations. LRP insurance offers a safeguard versus rate changes and guarantees a degree of stability in an uncertain market atmosphere. It is a sensible choice for securing animals financial investments.

Report this wiki page